Auction strategies, relative value should pick up as collateral plays are more dynamic.

- The Pension bid we have experienced in the long end of treasuries for all of 2018 is gone, pensions had till September 15th to front load their pension expenses at the 35% tax rate deduction. The new 21% corporate tax rate is now in effect.

Stripping activity was the best indicator to follow that flow, it finally reversed in August.

(source Macrobond)

- Deficits and Monthly treasury supply is intimidating, we just passed the 1 trillion (yes with a T) Monthly supply mark during the August refunding month, a staggering number!

(Source Sifma)

- SOMA : The Fed has implemented Caps (24bn for September, raises to 30bn for October 2018); that means the Fed will not participate in the upcoming auctions to reinvest the coupons it receives from its blotted portfolio unless the coupons are above a certain treshold (30bn), part of taper.

Expect less back bid for treasuries at the auctions and potentially more tails or at least more premium plays into and out of the auctions.

- Tic Data, less buying of treasuries from Foreigners, not a new phenomenon but net foreign is still negative, trade wars will not help.

(Source Treasury)

Overall, I expect Treasuries' auction strategies to start working again, duration plays (day of the auction), curve, flies and swap spreads T-5/T+5 from the auction...

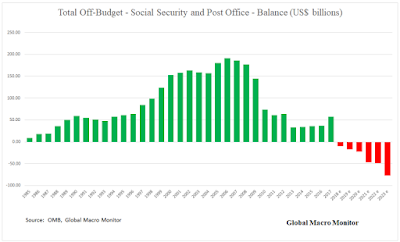

- Social security in the red from here, with inability to tap the social security trust fund

(Source Global Macro Monitor)

- Quantitative Tightening and "Reserves fracking"

US surprise indices and data was very healthy in Q3.

Inflation and wages are on the rise accross geographies.

More importantly, money markets are feeling the switch from Reserves excess to Collateral excess. Experiencing a world where most participants manage their cash deposits at the Fed vs the banking system, what Zoltan Pozsar calls the "Shadow funding black holes". The Fed is not recycling that cash so it means lower lending, lower turnover, lower velocity and scarcity of dollars.

Quarter end turns are more severe and require JP Morgan to step in to facilitates. It comes at steep prices (LCR and SLR constraints binding them and requiring premium rates to compensate for ratio deterioration).

Overall it means higher financing rates for the system and more expensive cross currency basis.

The trifecta, Rising rates, Sterilization of reserves thru FX swaps and Reserves squeeze thru Balance sheet taper is putting enormous pressure, pushing o/n rates higher and flattening curves.

Banks went from repo lenders to repo borrowers, an expensive way of getting cash back, adding to the collateral excess in the system.

- Carry makes flatteners expensive from here

- Inflation

Inflation is picking up, wages, commodities...and Tips markets are noticing with inflation indices breaking significant technical levels

20y tips index

(Source Nordea)

Overall, massive deficits and more dependencies on domestic players to fund it, requires higher risk and term premiums.

Rates markets should become more interesting for macro players after years of no volatility.

The next crisis should also come not from banks this time but leveraged weak Corporates. These players don't have access to the Fed to fund themselves. Banks and markets will price things accordingly when the time comes especially in this Reservesless world!