Summer 2018

If the economy is still strong in the US, globally some cracks are appearing, dollar strenghtening has weakened Emerging markets, China is facing trade tariffs from the Trump Administration, in response they are lowering their leverage standard releasing 100bn of liquidity in the system, Canada and LATAM are also hurt by Nafta rethoric and internal issues (Brazil, Argentina), geopolitical risks are also on the rise with a mid term election coming fast...

Time to step back, put some cash aside and understand what might give

Liquidity is drying up fast...quantitative tightening, stronger dollar and global central banks QE programs ending

Excess liquidity (Real M1 yoy - GDP yoy) turning negative for the first time

Nordea clearly shows excess liquidity correlation to dollar

Curves as predictor of recessions,

Well curves are already inverted depending which one you follow

JPM uses its own weighting for global sovereign curves (overweighting US)

Credit is also fairly stretched

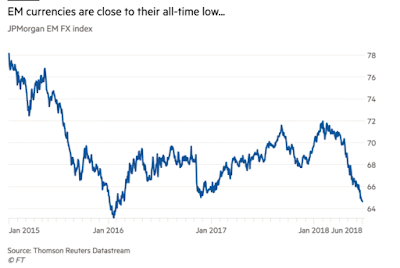

EM bonds and FX suffering despite some good performance for some commodities

No wonder china is releasing more iquidity in the system

S&P index does not offer as much diversification anymore, might be time to move some passive investments into more active strategies

Portoflio concentration is at an all time high

Bonds are a better investment than dividend paying stocks

Stock yields vs bond yields again showing equities stretched

Smart money is better at reading tea leaves and better sellers than buyers SPX

Finally, bitcoin is down 70% but surprisingly its volatility is also down quite a bit, believers are still not washed out?

Happy summer, trad'em well